Checkout, Taxes, and Fees

Find out more about all options available for the checkout, taxes and fees by reading this article

Last update [Mar 8, 2022]

Last Update: December 17, 2025

In this article, we will go through the following 3 available tabs menus in the Checkout Taxes and Fees dashboard (click to navigate directly to that option):

Overview

The Checkout, Taxes, and Fees menu is available by following the steps:

- Going to your Admin Desk

- In the main navigation, click on Settings > Merchant Settings > Checkout, taxes, and fees

(See the video below for additional help)

________________________________________________________________________

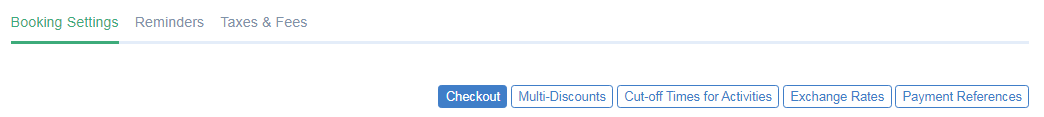

Booking Settings (first tab)

There are 5 tabs in the Booking Settings Dashboard:

Let's review the 5 tabs in more detail.

Checkout

- Custom Booking Number: This option allows you to change the booking numbers that TrekkSoft randomly assigns to your baskets. Every time you want to start a new period, don’t forget to set it back to 1!

- Tracking: The tracking option enables you to enter tracking codes that need to be inserted in your booking process and/or thank you page.

- Confirmation: The confirmation options below are additional options you can add/remove to the email that is sent when the booking process has been completed by one of your guests/customers.

TIP: You can enable/disable options to make the guest aware the payment has not been completed, add additional information about the activity, Attach your Terms of Service, and Watermark the booking confirmation.

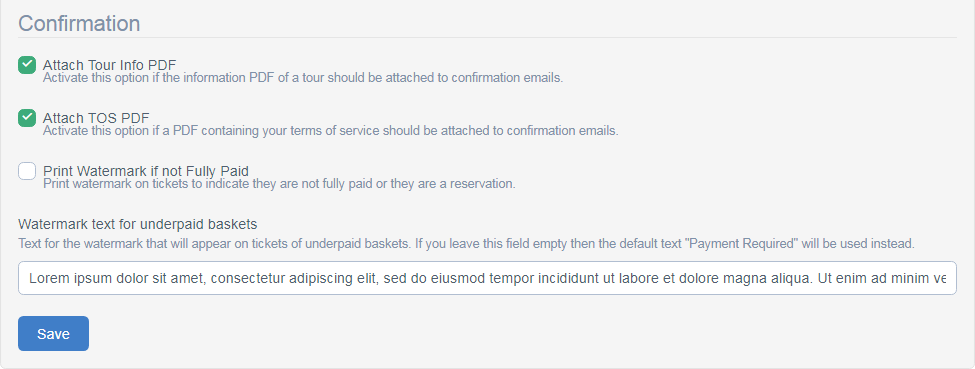

Multi Discounts

The multi discounts option allows you to enable a percentage discount automatically if a customer purchases 2 or more activities. There are options to book different discount amounts depending on the number of tours they book. See the screenshot below for further clarification.

In the website builder, the multi discount banner will only show, when the first selected activity is enabled for multi discount. While in the Booking Widget, the banner will always show, even if the first selected activity is not enabled for multi discount.

Example: An activity is not enabled for multi discount, then after having added it to the cart, the multi discount banner will show that adding 2 additional activities will give a discount of 4%.

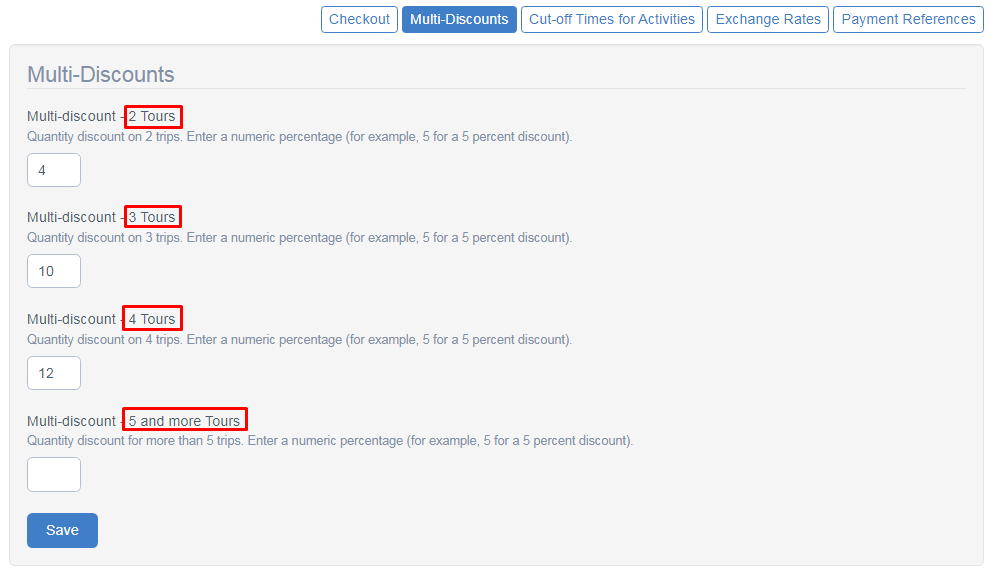

Cut-off Times For Activities

This section allows you to establish a default cut-off time for all your activities. Read more about cut-off times here.

Exchange Rates

You can manage and customize the exchange rates for each of the additional currency setups for your account with respect to your default currency. Get more details on currency setup for your account here.

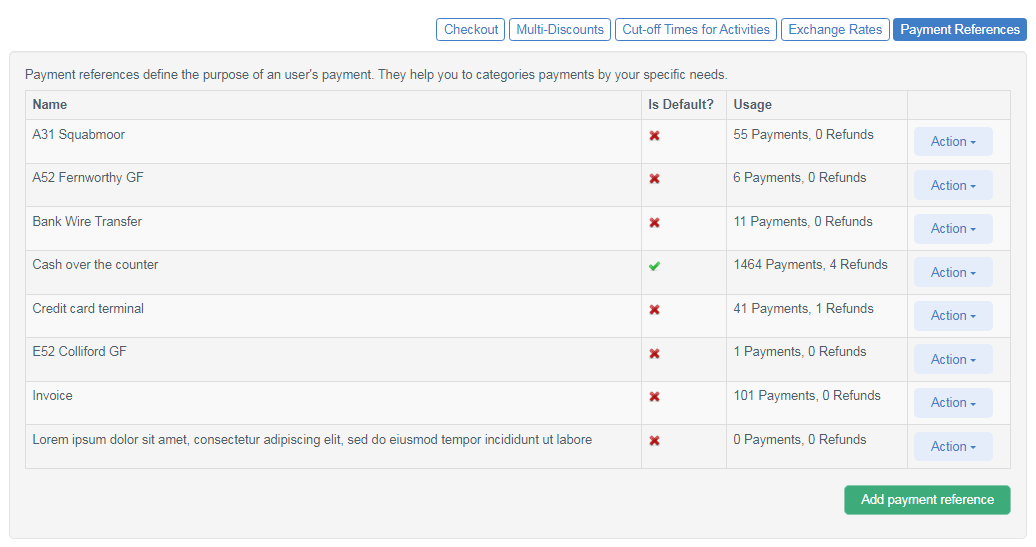

Payment references

Payment references help you to categorize payments by your specific needs. On this page, you can create as many payment methods as you require.

________________________________________________________________________

Reminders (second tab)

The reminders section gives you the option to enable/disable pre-trip or post-trip email to your guests. This means you can notify your guests of any important information before and after trips occur.

There are 2 options you can choose from:

- Pre-trip Reminders - Activate this option if you wish to send out reminders prior to the start of the activity.

- Post-Trip Email Reminders - Activate this option if you wish to send out reminders after the activity has been completed.

Note: Underneath each of the 2 options, is an 'offset' option. The offset option is used to state how many days before or after an activity you would like to send an email, for example Pre-trip email reminders, if you set the offset as 1, an email will be sent one day before the activity begins.

Tip!

Pre Trip Reminders - The email can be used to remind your guests not to forget any equipment, a reminder of the activity details, to wear comfortable clothing for a hike, etc.

Post Trip Reminders - This option is good for getting feedback from your guests e.g. you can ask for your guests to rate your activity on TripAdvisor!

________________________________________________________________________

Taxes and Fees (third tab)

TrekkSoft allows tour and activity providers to customize their booking systems by adding their own taxes and fees. This is great for companies that require guests to pay tolls or other costs that occur during activity.

Companies can also track different taxes that apply to their business using the accounting report, which will show which taxes each customer paid and displays each tax/fee individually. You can find more about reporting here.

Creating a New Tax or Fee

To create a new tax or fee:

- Go to Settings > Merchant Settings > Checkout, Taxes & Fees

- In the tabs menu, select the Taxes & Fees tab

- Click the Add New Tax/Fee button. Now, complete each of the fields below:

-

- Title

The name of your tax or fee. - Tax or Fee

Select either “Tax” or “Fee”. Tax is calculated by taking a percentage, while Fees are fixed amounts that are added to the balance of an order. - Value

The value of your tax (a percentage) or fee (a fixed amount). - Tax Code

The code is the corresponding account number that will be exported in the tax report. This allows an easier synchronization with your bookkeeping. This field is optional.

- Title

-

- Inclusive

If this option is ticked, TrekkSoft will include the tax/fee in the cost of your activity or item. This means any existing prices will not be changed. If unchecked, this value will be added to your customer’s basket in addition to the cost of the item or activity. - Compounding

If marked, this new tax will be calculated based on the total cost of the activity or item plus any additional taxes or fees that have already been applied to the transaction. Otherwise, the original price of the item or activity will be used for the calculations. - Componental

This tax will be applied to the additional services you provide with your trips (food, transportation, insurance, etc). The value input will be a percentage of the total price of the service. You can catalog them on the taxes page and add them to your activities. To all of them, or just some of them.

- Inclusive

5. Once you have entered this information, click the Save button.

Taxes Report

Once you have added your custom taxes and fees, you can check the Taxes in the reporting section. To view your Tax Report:

- Go to Reporting > Sales > Turnover.

- In the tabs menu, select the Taxes & Fees tab (as shown below)

This report is very useful for keeping track of legal taxes that you are required to report, as well as recording any general expenses related to your business.

Find additional information on compounding and componental taxes and the tax report here.

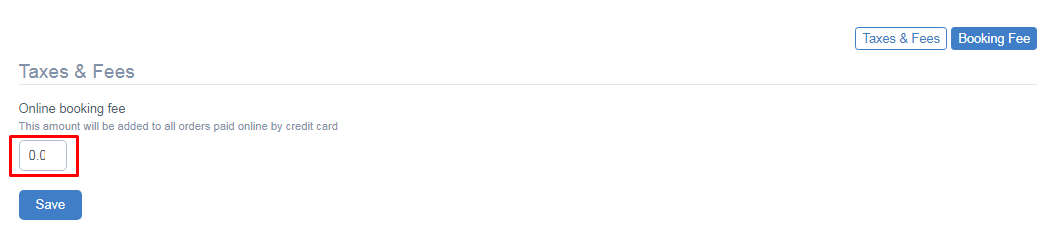

Booking Fee

To create a new booking fee:- Go to Settings > Merchant Settings > Checkout, Taxes & Fees

- In the tabs menu, select the Taxes & Fees tab and then click the Booking Fee button

- You can set up an Online booking fee for all the activities sold online from your website. This amount will be added to all orders paid online by credit card.

FAQ on Booking fee

- If a merchant sets up a booking fee of i.e. 0.50 cents and the activity, say EUR 100. Then the end customer pays EUR 100.50 right? >> Yes.

- The online commission from TrekkSoft is charged over EUR 100 or the 100.50? >> On the 100.

- The Payment Gateways commission from Payyo is charged over the EUR 100 or the 100.50? >> On the 100 as well.